What can we learn from Rental: the original “servitized’ business model?

Most OEM’s today rely on networks of distribution and service suppliers, while in the digital, totally connected, more circular economy of the future, the merging of assets and services into cohesive deliverables under singular contracts becomes necessary.

How can the Advanced Services vision become a reality for all parties in the value chain?

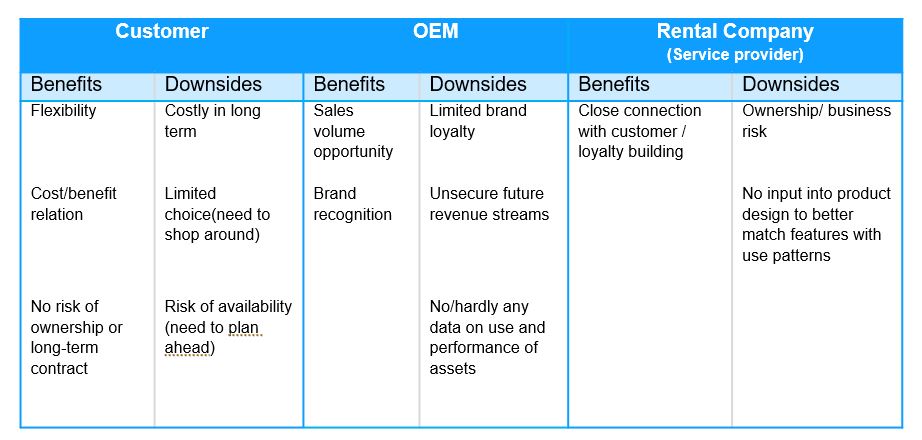

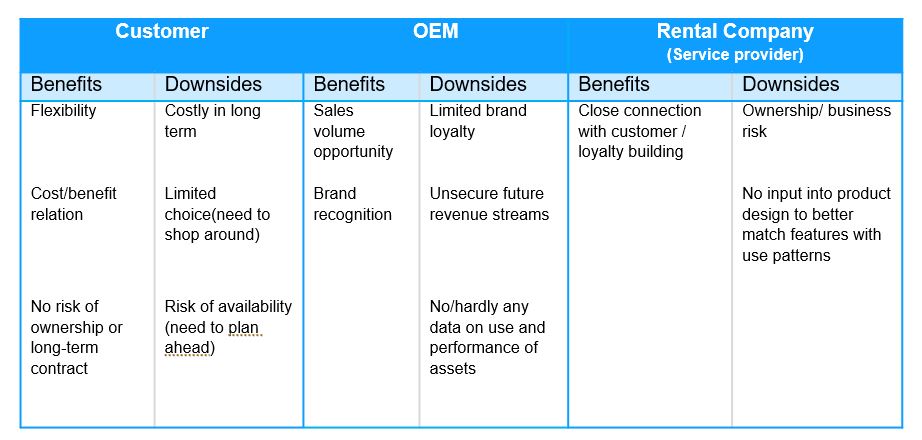

To begin to answer this question, let’s look at perhaps the original “servitized” business model: Rental. Why? Because in a rental, the customer obtains use of an asset and associated services under a singular contract for a given period for one global charge. Is this not the essence of asset-as-a-service? That is not to say Rental is a universal servitized solution, but it is a useful example of how a servitized solution can work. Let’s look at the benefits and drawbacks for each actor in the rental value chain to appreciate the building blocks of servitization and consider how the model may be optimized to create something even more appealing to customers, that is better for OEM’s and creates revenue opportunities for all the players.

- For customers, the key benefit is flexibility and choice. Because the customer rents the equipment as and when they need it, there is a direct cost/benefit correlation, and the risk of ownership or long-term contract is avoided. The downside is that rentals are generally short term in nature and can become quite costly. Also, rental typically provides a limited number of choices and there is always the risk of availability, so planning ahead is still necessary as is shopping around.

- For OEM’s who sell assets into the rental sector, this type of business represents a sales volume opportunity, through frequently at commoditized prices, but it does help the manufacturer to build brand recognition. The biggest challenges for the OEM are that it is challenging to build brand loyalty, secure future revenue streams, and line of sight to data around use of the assets may be completely obscured.

- And for the rental company, well, they have taken on the greatest risks, hence they stand to reap the greatest rewards. This includes a very close connection with the customer where loyalty is built. The risks on the part of the rental company are clear, and we see these play out right now with well-known rental companies out there.

What can we learn from Rental as a model for Servitization?

Does the rental company fill a customer need? – clearly yes. Is this an efficient or desirable busines model? – perhaps, it depends on your perspective and your goals.

Interestingly, the actor you don’t see here is a Funder. DLL’s business involves providing different types of financing and leasing to each of the players here to facilitate the transactions between them. And from this funder’s perspective, I see both the benefits of this model but also its inherent inefficiencies. If I view Rental as “asset-as-a-service”, I see a first-generation servitization concept with great opportunities for improvement. And this requires all the players, funders included, to think and act differently.

Servitization 2.0.: Multiple players must seamlessly collaborate

To bring Servitization to the next level and broaden its reach, we need to recognize that multiple parties must seamlessly collaborate. In Servitization 1.0, the rental company made the single contract and service provision a reality for the customer. In a future, more cost effective, more customer-centric form of Servitization, a single contract to the end-user is similarly essential. This requires contract management including payment and funding be centralized and closely coordinated with the provision of assets and services. In my view, this means the funder must come out from behind the scenes and assume a key facilitating role in the ecosystem.

How do the parties in the ecosystem work effectively together to deliver a cohesive, superior customer experience?

- It starts with understanding the Customer. Convenience, flexibility, and simplicity at a competitive price are desired, yet this does not align with ownership and today’s contracting practices. Many assets are needed on a recurring basis, but not every day, yet short term, high cost rentals are neither practical nor economical, if even available for many asset classes. Many of these customers today opt for leasing which is less costly and risky than ownership, but still involves a la carte contracting, service obligations and a lack of flexibility to directly match cost to benefit. To the customer, the way in which they pay is as central to the value proposition as what they get.

- The OEM desires broader reach to earn revenue throughout the lifecycle of the asset and desires control the customer footprint. But realistically, what is the average OEM’s ability to change its revenue model overnight or grow or acquire an entire field service organization? OEM’s need a partnership and financial model that enables delivery of its product to the end customer as a service while building a bridge from a sales-driven operating model to a lifetime value model.

- Service organizations also want to benefit from all stages of the asset lifecycle and hold the customer close, but their goals are sometimes at odds with the OEM and customers are expensive to acquire and challenging to maintain. What is the independent service provider’s role in a model where customers don’t want to separately buy assets and services but rather buy outcomes? With the customer as the focal point of all parties and the asset and contract seen as the key enablers, service providers can change OEMs from suppliers to partners… partners in care of the customer.

- And finally, how do funders move from balance sheet underwriting and time value of money contracting to a performance-based environment where risk is focused more on the customer’s usage and the asset’s lifetime earning potential? It starts with seeing the similarities in business models of today with busines models of tomorrow. The counterparties may change, the contracts may evolve, the risks may be redistributed, but the fundamental role of the funder remains as key facilitator in the movement of assets from factory to market and movement of funds between participants.