When you think of a traditional lease, the structure that you’re thinking of is most likely a fair market value (FMV) lease. This is a type of financing that allows the customer or lessee to use the asset for a pre-determined amount of time in exchange for a fixed monthly payment. At the end of the lease term, the lessee has the option to buy the asset for what it is worth at that time, also known as its fair market value, return the asset or continue using it for the established monthly payment.

A company may choose an FMV lease when it needs an asset to increase production but doesn’t have the capital to buy the equipment outright. This approach allows the company to benefit from using 100% of the asset while only paying a small monthly percentage or payment. Moreover, the company also has the flexibility at the end of the term to choose whether to buy the equipment it is familiar with, upgrade to the newest technology, or return the asset and reallocate the costs.

If company purchases an asset outright, it is responsible for assessing price and finding a buyer if they no longer want or need it. When company instead chooses to lease with business-to-business financial partner like DLL, equipment can be assessed for what it is worth (residual value) at the end of the lease, potentially reducing your monthly payment, while setting the appropriate fair market value.

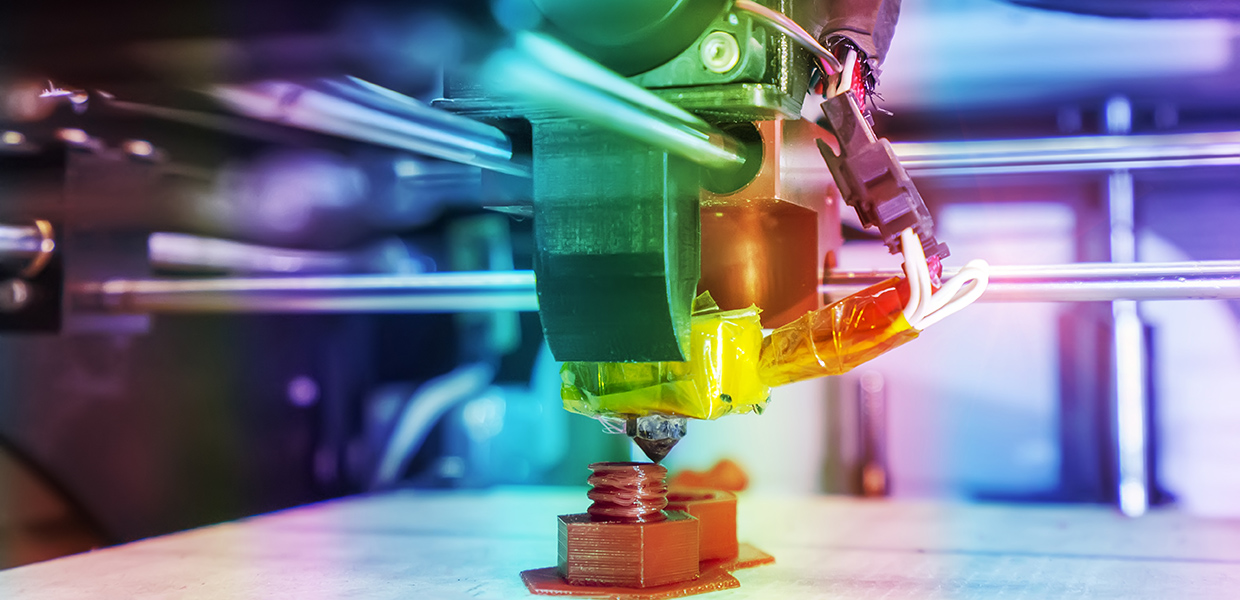

Many different types of business-critical equipment can be leased in a FMV structure, from construction to manufacturing to technology. Fixed assets may also be eligible for leasing—and you also may be able to include installation costs in your lease. Whether it’s an asset that will be used every day or on a less frequent schedule, the amount of usage permitted in the lease can be set upfront in the contract. This allows financial partners like DLL to appropriately gauge the value of the asset at the end of the lease term and better calculate your payments over that time.

By choosing an FMV lease, with potentially a lower monthly payment than a loan, a business could invest the saved costs into other assets and scale up their business more quickly or invest the capital into other business-essential needs.

So, if you are looking for the most end-of-term flexibility and lower monthly payments, an FMV lease should be high in your consideration set. When you’re ready, give us a call to learn more about what DLL’s equipment finance team can do for you.